Making Quantitative Research Meaningful

Recent projects have involved working for a leading European retailer in bidding for the contracts to operate new sites at major transport hubs as concessions from the site owners.

The Brief

Orrani’s task has been to provide clear analysis of the customer dynamics at these extremely busy European sites, which featured significant levels of public and trade footfall and multiple locations with different characteristics.

The core objective was to provide marketing insights (and supporting data) to enable the retailer to position its bid propositions as effectively as possible, based on the learnings gained. On successful completion of such tenders, these insights then allow it to optimise its eventual store configuration and range offering. A key aspect of the process is also to support the retailer’s added value relationship with the site operators.

These research projects are critical to the retailer’s international development. The company requires a research partner with:

- Strong business and marketing experience

- Very robust analytical capabilities

- A global resource network which can guarantee implementation of such projects in the demanding timeframes that the business development context dictates.

Our Approach

Orrani’s team’s extensive experience in using data to empower business decisions has led to an approach that centres on a simple six-step continuous cycle:

- Objectives: what do we need to know and from whom?

- Design: how do we sample and measure the target population?

- Fieldwork: how to collate, clean and code our responses?

- Results: what should we do with the non-responses and how do we describe the results?

- Insights: what are the key drivers and how do these differ by different segments of the population?

- Decisions: what actions can be taken?

Sufficient discussion at the initial step is absolutely key, as objectives which are poorly understood, imprecise or too numerous are all sure routes to bad surveys.

All research on these projects has been done through face-to-face interviews at very busy locations, with the resulting data fed into Excel for detailed statistical analysis.

One challenge in each location has been that the customer traffic has often comprised people using the transport site for non-transport reasons: these can be local shop staff, meeters and greeters, local residents using the location for shopping or even just passing through to avoid bad weather!

As always, one of our priorities has been to develop segmentations relating to the business questions that need to be addressed. Traditional customer segmentation is often based around WHO the customer is (demographics). However, of far greater value are segments based on what customer is DOING (their behaviour). For example:

- WHAT are customers buying? Product info

- WHEN are customers buying? Date & time info

- WHERE are customers buying? Location info, online/offline

- HOW are customers buying? Payment method, usage of offers

Our Solution

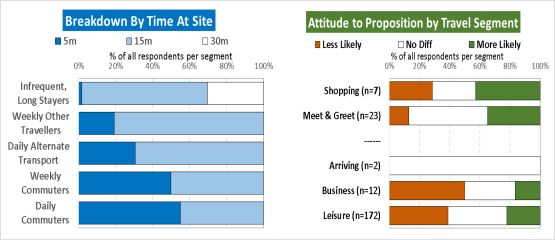

These projects have provided our customer with comprehensive reports that, in turn, enabled them to build effective business cases based on actionable data in each bid process. Examples of typical graphical output :

Orrani can do the same for any business that wants to grow its scale and improve its operations based on hard data!

Email us at orrani@orrani.com or call us on + 44 (0)1225 318 222 or +1 (303) 908-7274 to discuss how we can help your business be more effective.